Don't rely solely on information on hand for your retirement investment

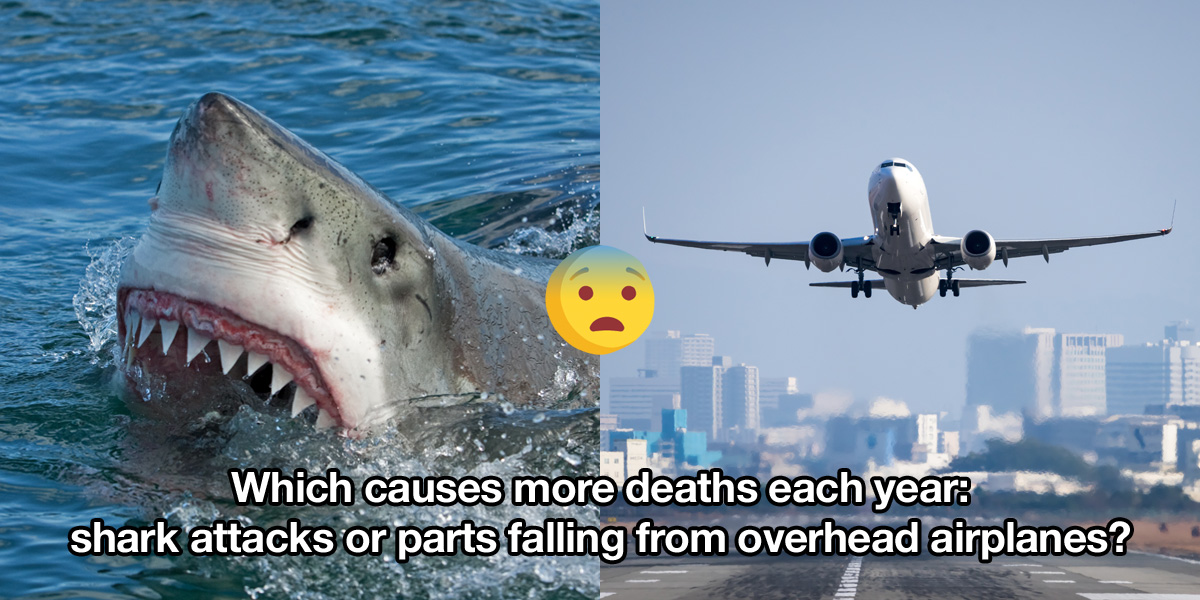

“Be fearful when others are greedy and greedy only when others are fearful.” This famous statement by Warren Buffett is familiar to many, but it is not uncommon to see investors collectively acting over-optimistically or in panic mode in response to market events. This behaviour is often the result of a common psychological bias. Before further discussion, please answer a quick question. Which do you think causes more deaths each year: shark attacks or parts falling from overhead airplanes?

“Be fearful when others are greedy and greedy only when others are fearful.” This famous statement by Warren Buffett is familiar to many, but it is not uncommon to see investors collectively acting over-optimistically or in panic mode in response to market events. This behaviour is often the result of a common psychological bias. Before further discussion, please answer a quick question. Which do you think causes more deaths each year: shark attacks or parts falling from overhead airplanes?

According to studies, most people think it is shark attacks, but statistics from the US showed that there were 30 times more deaths annually caused by falling airplane parts than by shark attacks! Why is there such a large difference between our perception and the facts? It is probably “availability bias”.

According to studies, most people think it is shark attacks, but statistics from the US showed that there were 30 times more deaths annually caused by falling airplane parts than by shark attacks! Why is there such a large difference between our perception and the facts? It is probably “availability bias”.

“Availability bias” hinders retirement planning

“Availability bias” hinders retirement planning

Availability bias is a psychological bias that affects rational decision-making. In the above example, the instant response for many of us is to think about how falling airplane parts could hit somebody – something most of us rarely hear about and find quite hard to imagine. On the other hand, shark attacks make headlines, and the animals often appear in movies as brutal killers, making it much easier to picture a shark killing a person. As we can see, the ease of obtaining information and making associations influences our thinking, leading to erroneous conclusions.Here is another everyday example: Many people are afraid of flying, even though it has been proven that airplane crashes happen much less frequently than car accidents. However, because of flashy movies and widespread media coverage, images of airplane crashes more easily come to mind, leading many to develop a fear of flying.

From an investment perspective, examples of the impact of “availability bias” abound. When the stock market is doing well, friends are eager to share their profit-making secrets, financial reports paint a rosy picture, and quite a lot of experts and advisors suggest investing aggressively. Investors receive only one-sided, optimistic information, making it difficult to associate this with the panic and pessimism of previous market falls. Investors rush into the market, with no mind for appropriate, cautious risk management. But when the market takes a downward turn, suddenly the market is full of pessimistic investors and bearish news, and everyone rushes for the exit.

From an investment perspective, examples of the impact of “availability bias” abound. When the stock market is doing well, friends are eager to share their profit-making secrets, financial reports paint a rosy picture, and quite a lot of experts and advisors suggest investing aggressively. Investors receive only one-sided, optimistic information, making it difficult to associate this with the panic and pessimism of previous market falls. Investors rush into the market, with no mind for appropriate, cautious risk management. But when the market takes a downward turn, suddenly the market is full of pessimistic investors and bearish news, and everyone rushes for the exit.Influenced by “availability bias”, investors tend to invest in asset classes and regions they are familiar with. Many stock investors, for instance, barely pay attention to information on the bond market, so they never consider investing in bonds. Investors who have “home bias” – focusing only on the local market – may miss better opportunities elsewhere in the world. According to MPFA statistics, as at the end of September 2018, 60% of MPF funds were invested in the Hong Kong market. In general, if we wish to effectively manage our retirement investment, we should allocate our assets properly. Investing in a variety of asset classes and regions can help balance risks and returns in long-term investments.

Look into diversified information

Look into diversified information

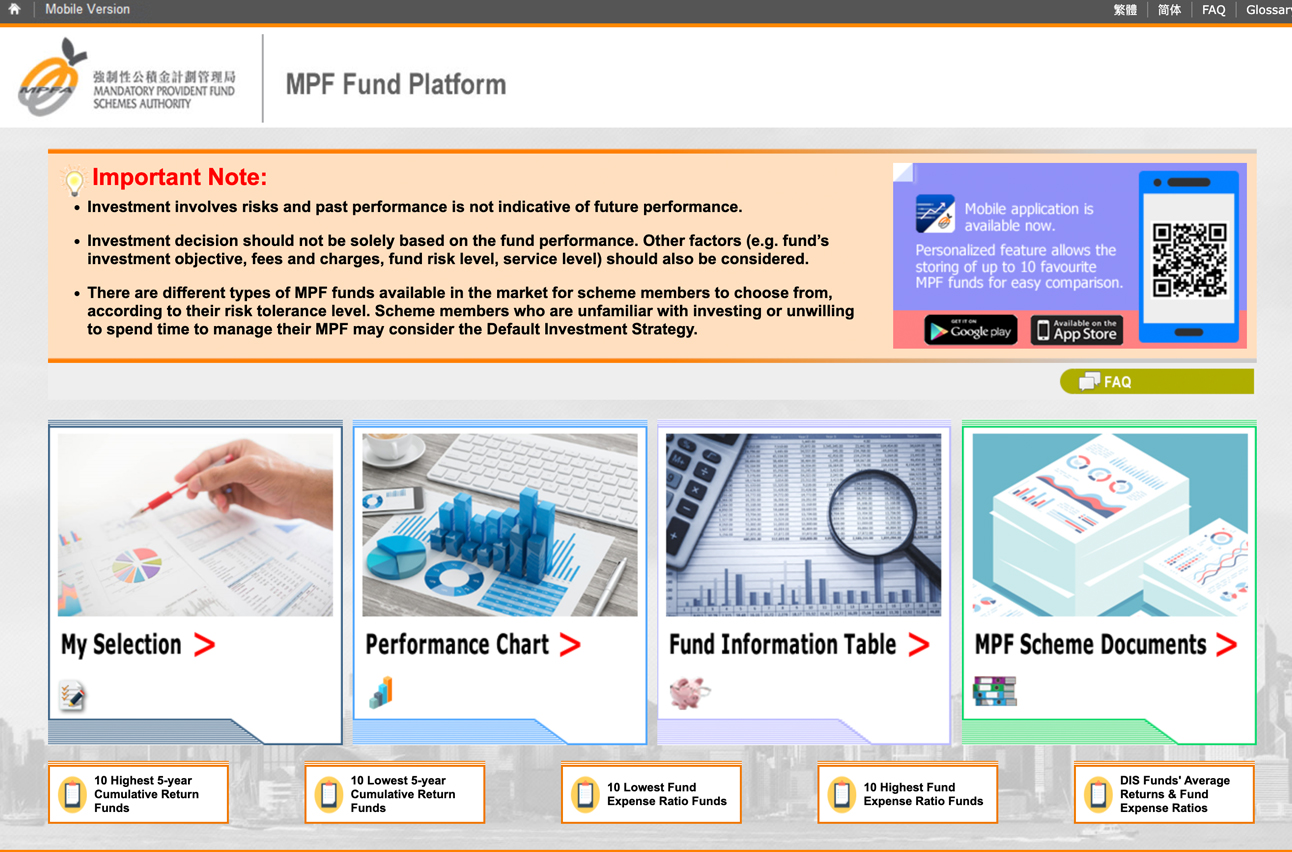

To battle “availability bias”, you have to do your own research for comprehensive understanding of the facts. That means relying not solely on readily available information, but instead going out of your way to seek long-term data via different channels. This will help you avoid making inappropriate, short-sighted decisions and build a long-term investment strategy tailored to your needs and risk tolerance level.A host of MPF documents and tools are available to help you obtain comprehensive and reliable information. The “Fund Fact Sheet”, for example, is like a resume for MPF funds, listing the basic information of each fund, including its net asset value, fund expense ratio, and commentary on fund performance, investment policies and objectives. In addition, the MPFA’s MPF Fund Platform provides information about the return, fee and risk level of each MPF fund, allowing you to understand fund features from different perspectives and decide whether a fund is suitable for your retirement needs.

Diligence is the key to retirement planning. Use these MPF tools to overcome “availability bias” and make rational long-term decisions for your retirement!

Kenny Mak – Chartered Financial Analyst

Click here to series of “Overcoming blind spots for a happy retirement”

Click here to series of “Overcoming blind spots for a happy retirement”